The AVI Approach

It is well known that diversification is key to reduce the risks associated with over-concentration in a few stocks, industries, countries, etc. Whilst this is indeed true, there is another area of diversification overlooked. Diversification of the investment strategy itself.

It is very common for retail investors to identify a single investment strategy and sticking to it. Whilst this works for many investors some of these processes can be hard to follow as they require the emotional fortitude to sit on the side-lines and wait. However, by utilising the vast variety of investing strategies and sub-strategies available in tandem the desire to interfere can be lessened, therefore further reducing investment risk.

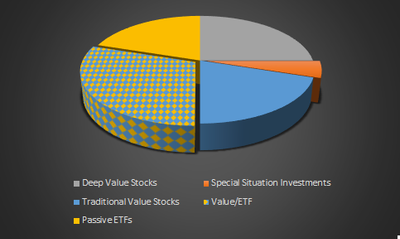

Focusing on value investing strategies, the AVI approach consists of the following; Traditional Value Stocks, Special Situation Investments, Deep Value Stocks and Passive Exchange Traded Funds (ETFs).

Diversification

Diversification is a hot topic, with some investors such as Warren Buffet and Charlie Munger describing it as "protection against ignorance. There's nothing wrong with that.". Their purpose here is to encourage the average investor to focus on low cost ETFs that track the market. It is well know that by tracking the market via these types of ETFs, investors can see returns of 7-10% per year (over a long period of time) without any need to actively manage a portfolio.

Additionally, Peter Lynch coined the term Diworsification, intending to point out the fact that companies (and fund managers) that spread themselves too thin do so at the detriment of returns. Encouraging investors that do wish to outperform the market to keep the number of stocks they own to a manageable level (10-20 stocks).

As such, the AVI Strategy has been developed with both these principles in mind. By maintaining a level of passive investing, whilst coupling this with actively managed investment strategies, the AVI approach enables investors to minimise risk through diversification without overstretching themselves.

To explain, the AVI Strategy can require investment in up to 40 individual stock at any one time, however, as few as 12 to 14 of these stocks are actively managed (and often enough this number is closer to 8 to 10 actively managed stocks).

The principles of the value investing strategies behind the AVI approach are focused on outperforming the market benchmark of the S&P500. To better understand each part of the AVI Strategy and how they integrate into this strategy, please refer to the other sections within the Investment Strategy menu.

AVI Strategy Components

Special Situation Investments

A strategy focusing on the failures of institutional investors

Learn More